Common Questions & Due Diligence

Straight answers about our fee model, audit process, and risk profile.

-

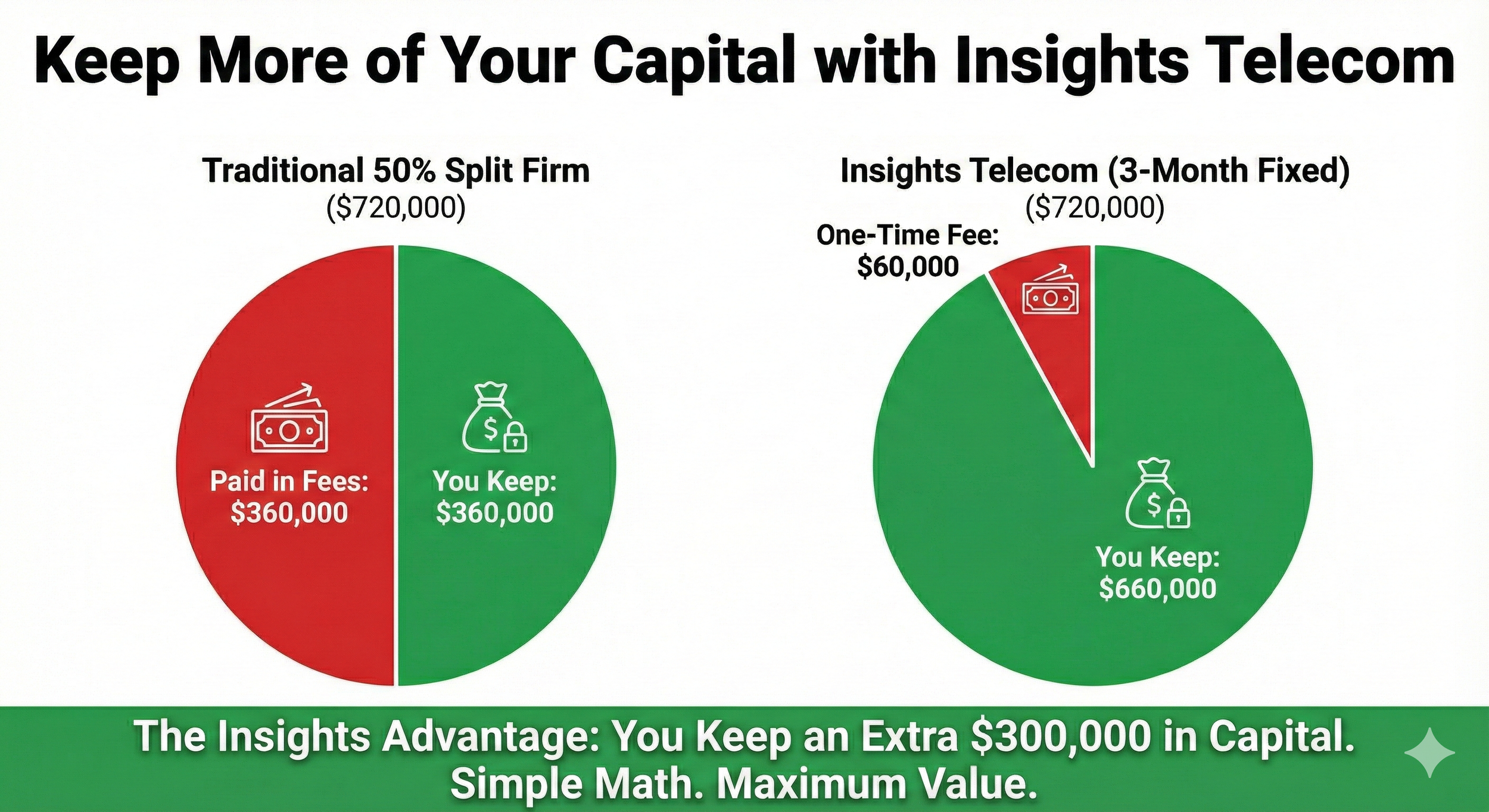

We rejected the industry-standard model because we believe it penalizes you for finding significant savings. Most firms take 50% of your savings for 3 to 5 years. The Insights Difference: We operate on a 3-Month Fee Cap. You pay a one-time fee equal to just 3 months of the verified savings we secure. After that, your community keeps 100% of the recovered capital forever.

-

Then you owe us $0. Our audit is 100% contingency-based. If we cannot find recoverable capital or billing errors, you receive a complimentary "Clean Bill of Health" report validating your current rates, and there is no cost to you.

-

No. In fact, 70% of the capital we recover comes from your existing vendors. We identify billing errors, remove "ghost lines" (services you pay for but don't use), and re-rate legacy contracts to current wholesale market rates—usually without changing the provider. We only recommend switching if the service degradation or price difference is extreme.

-

We designed our "Non-Intrusive Audit" specifically for busy Operations teams. We need less than 2 Hours of your time to provide us with copies of your recent invoices (via our secure portal) and sign a Letter of Authorization (LoA). We handle the analysis, carrier disputes, and negotiation entirely off-site. Your team stays focused on resident care.

-

We perform a forensic audit of the entire "Fourth Utility" stack. This includes:

WAN & Fiber Circuits

Dedicated Internet Access (DIA)

Managed Wi-Fi

Voice (PRI, POTS, VoIP)

Bulk TV & Content Packages

-

No. Our audit is administrative and financial. When we clean up billing errors or renegotiate rates with your current carriers, there is zero physical change to your network. If a vendor change is ever required for savings, we coordinate the cutover with your IT team to ensure redundancy and uptime.

-

We work with both. While large portfolios (REITs, Multi-site Operators) often see the largest aggregate savings due to economies of scale, single-site communities are often the most overcharged because they lack purchasing power. We bring "Portfolio Pricing" leverage to single-site operators.