The Capital Recovery Process

Senior Living operators often unknowingly overpay for technology and communications due to complex billing codes, 'auto-renewed' legacy contracts, and unused inventory. Our process is designed to act as an extension of your finance team. We perform a forensic audit of your historical spend to identify found capital—all while ensuring your communities remain HIPAA compliant and fully connected

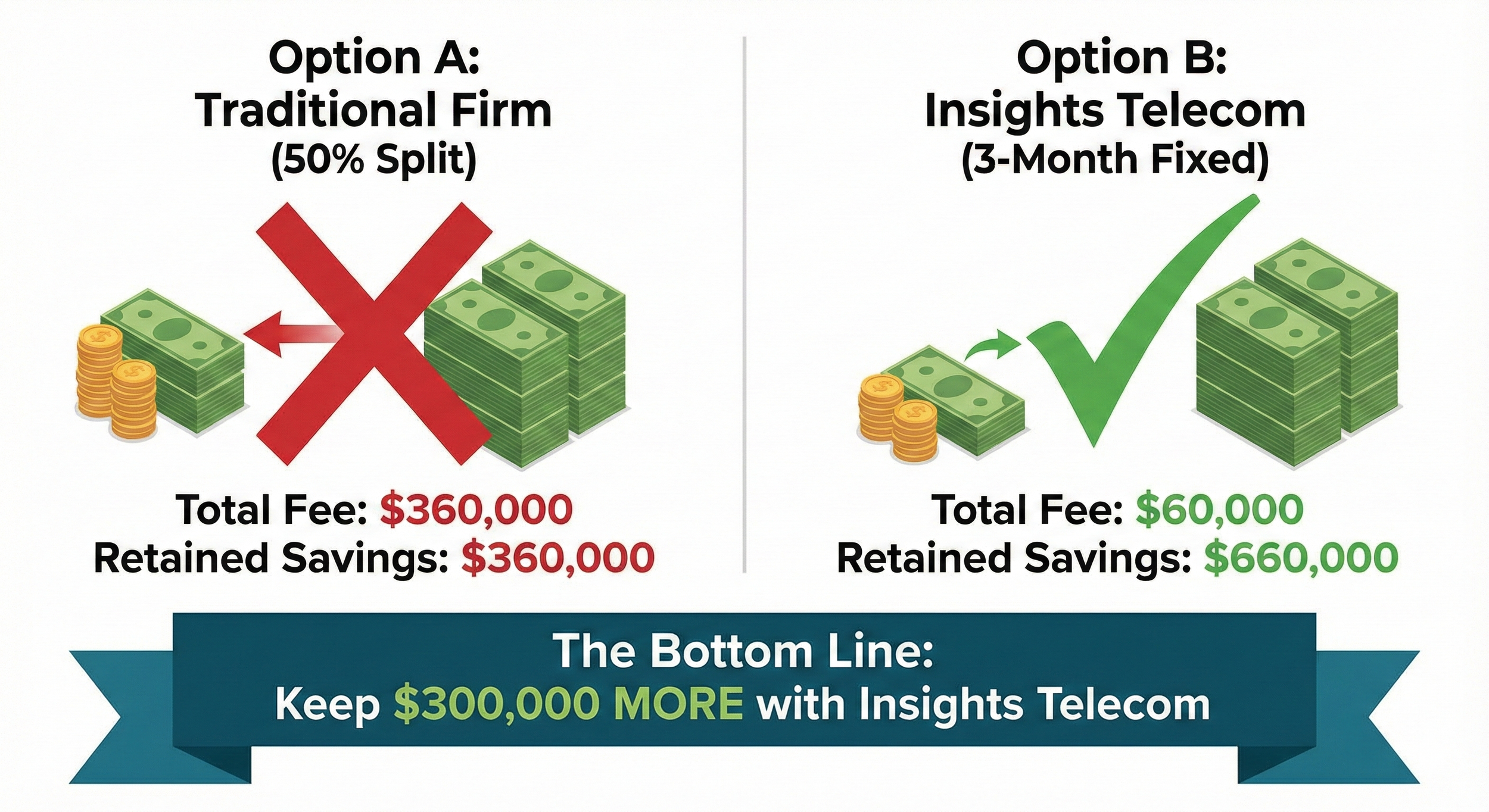

The Cost of "Shared Savings" vs. Insights Telecom. Most firms charge 50% of your savings for 36 months. We charge a one-time fee equal to 3 months of savings. Here is the actual financial impact on your budget:

Scenario: We identify $20,000/month in savings ($720,000 over 3 years).

Option A: The Traditional Firm (50% Split)

You pay them $10,000/month for 36 months.

Total Fee: $360,000.

Your Retained Savings: $360,000.

Option B: Insights Telecom (3-Month Fixed)

You pay us a one-time fee of $60,000.

Total Fee: $60,000.

Your Retained Savings: $660,000.

The Bottom Line: You keep $300,000 more in capital by choosing Insights Telecom for the exact same result.

The 'Client-First' Pricing Model

__________________________________________________________________________________________________________________________________________________________________

The "Carrier-Funded" Advantage

In many instances, our audit reveals that a migration to a new, lower cost provider or a technology upgrade with your current provider is the most strategic move for a specific service (such as DIA, VoIP, or Bulk TV).

How it Works:

When a client chooses to migrate a service or upgrade to modern technology (e.g., moving legacy POTS lines to POTS-in-a-Box or VoIP) based on our recommendation, the carrier typically classifies this as a "New Sale" and compensates Insights Telecom directly.

Our Transparency Commitment:

Fee Waivers: If a carrier compensates us for a service migration or technology upgrade, we waive our "3-month savings fee" for that specific line item.

Zero Out-of-Pocket: This effectively makes the forensic audit, the negotiation, and the implementation of that new service completely free for your organization.

Full Disclosure: Unlike traditional brokers who "double-dip" by charging the client and hiding carrier commissions, we disclose all carrier-side revenue and use it to directly offset your project and implementation costs.

Reinvest: Convert these operational savings into mission-critical budget for residents and staff.

__________________________________________________________________________________________________________________________________________________________________

Our Guarantee Your Senior Living organization has nothing to lose. If we audit your expenses and find no savings, you owe us $0. You receive a free verification of your invoices and the peace of mind that your budget is optimized.

The 4-Step Recovery Method

Step 1- The Non-Intrusive Audit

We start by securely ingesting your historical invoices (Internet, Voice, TV, Nurse Call). We conduct this review entirely off-site, meaning we do not need to visit your communities, and your Executive Directors are never distracted from resident care.

Step 2- Forensic Analysis & Benchmarking

We cross-reference your current rates against our proprietary database of Senior Living pricing. We know exactly what carriers charge other communities of your size, allowing us to instantly spot inflated rates, billing errors, and "auto-renewed" bad terms.

Step 3- Optimization & Negotiation

We handle the carriers directly. We dispute billing errors, remove unused legacy lines, and renegotiate contracts to market-best rates. Crucially, you maintain final approval. We never make changes without your explicit "Go" decision.

Step 4- Verification

We don't just promise savings; we prove them. We audit your subsequent invoices to verify the lower rates have actually hit your P&L. Once verified, we hand day-to-day management back to your team with a clean slate.